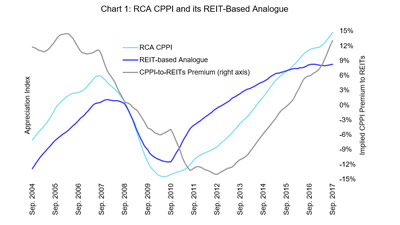

Although the lingering CRE valuation divergence has been disruptive, it has created opportunities for traders and benefited REITs. As public and private property values turn out to be extra in sync, REITs will likely continue to maintain up investment performance and acquisition advantages over their personal market counterparts. Well-structured stability sheets and efficient entry to cost-advantaged capital are anticipated to put REITs in the catbird seat for acquisitions. Whereas the public-private actual estate valuation divergence continues, a long-awaited goodbye to this dislocation could additionally be on the horizon within the coming quarters. The unfold between private and non-private actual property cap rates crested at 243 basis factors in the third quarter of 2022.

Private Fairness Inflows In Indian Actual Property Fall 15% In H1 Fy26: Report

- This data contained herein is certified by and topic to extra detailed info within the relevant offering supplies.

- Nevertheless, they have failed to handle its severity and come with substantial prices, including impeding the market’s worth discovery course of, limiting transaction market liquidity, and obliging investors to pay artificially high investment management charges.

- It is price preserving in thoughts that, while real property funds supply numerous potential advantages, their use in an general portfolio could be much less easy to assess when it comes to exposure and potential threat.

- Amongst different issues, this has sparked a wave of initial public offering activity in Singapore, particularly in the third quarter.

- Interestingly, returns are closer over the past 20 years, with NPI and Nareit both returning 7.1 percent earlier than fees, with NFI-ODCE barely lower at 6.5 p.c.

The Sharpe ratio for core real property funds was zero.36; worth added / opportunistic non-public equity actual estate was 0.35, and fund-of-funds was 0.25 because of its decrease returns. REITs delivered the very best average annual internet returns over the examine interval at 10.sixty eight percent. Internally managed core actual estate was second, with common annual net returns of 10.10 p.c. Internet returns of the externally managed non-public real property types had been considerably decrease, reflecting their higher administration prices. Core real estate funds had average https://www.personal-accounting.org/ annual internet returns of 8.34 p.c, and worth added/opportunistic funds had average annual web returns of eight.sixty six percent. Common annual net returns of funds-of-funds fashion were 6.86 p.c, reflecting this style’s further layer of management prices.

Importantly, publicly traded real estate has outperformed personal actual property over longer time durations. Throughout the past 30 years, public returns are one hundred twenty basis points to one hundred sixty basis points larger on an annual foundation. Curiously, returns are nearer over the past 20 years, with NPI and Nareit each returning 7.1 % earlier than charges, with NFI-ODCE barely lower at 6.5 p.c. Annual common gross returns for the three major U.S. actual property benchmarks were all between 5.7 % and 5.9 p.c for the ten years ending in fourth quarter 2024. Nareit serves because the worldwide representative voice for REITs and real property companies with an curiosity in U.S. actual property.

Nonetheless, most REITs pay out more than 90% of their taxable income as a outcome of their cash flows, as measured by funds from operations (FFO), are often a lot higher than web income since REITs are probably to report massive amounts of depreciation every year. Unbiased administrators, analysts, auditors, and the financial media all monitor REITs’ performance. This oversight provides REIT buyers a degree of protection so that administration teams cannot simply benefit from them for their very own gain. Nothing on this website is meant as a suggestion to extend credit score, an offer to purchase or promote securities or a solicitation of any securities transaction. Matthew Bullock is EMEA Head of Portfolio Development and Technique at Janus Henderson Traders.

Industrial REITs have seen property-level money flow growth hold up, however financial and tariff-related developments nonetheless pose the chance of a slowdown, which could impact progress in 2025 and 2026. Rent spreads have been one thing of a silver lining, and longer-term external growth prospects could presumably be more favorable given the sector’s development-heavy focus. The next webinar will be April 23 and will analyze first quarter performance of the FTSE Nareit U.S. Actual Estate Indexes. Fourth quarter REIT performance, the outlook for REITs, and the worldwide REIT industry took heart stage through the Jan. 14 “FTSE Nareit U.S. Real Property Indexes in Evaluate and What’s Next” webinar.

Reits Vs The Broader Cre Market

Outside the present property valuation divergence, the non-public appraisal cap price unfold over the 10-year Treasury yield was less than a hundred foundation factors only seven instances; it was lower than 50 foundation factors just two instances. Property sectors have typically carried out similarly over the previous 10 years in each the personal and non-private markets. Industrial and self-storage have been the leading property varieties for each, whereas office and retail were both underperformers.

Net lease REITs are sensitive to rate of interest modifications and have a tendency to perform higher in a decrease rate of interest environment. At the moment, the web lease sector is nicely positioned, with anticipated earnings growth consistent with the overall group, however with closely discounted multiples and higher dividend yields — typically above 5%. Real estate stocks had a powerful begin to 2025 — in March, the MSCI U.S. REIT Index was up 1.1%, while the S&P 500 was down 1.6% and the Russell 2000 was down 5.2%. However, because of turbulence in fairness markets and with the S&P 500 climbing in recent weeks, it’s difficult to say the place it will net out.

“We are watching the actions of DOGE carefully. Federal government employment has actual implications on the Washington, D.C., metro actual reit and private real estate performance property picture, and tons of REITs have exposure to this region.” Sturdy client spending and limited supply have supported retail REITs, significantly strip centers. There is presently a solid leasing setting, but the combination of some high-profile bankruptcies, dangerous debt assumptions and considerations about tariffs is clouding the view slightly.

Subscribe To Newsletter To Get Newest Insights & Analysis In Your Inbox

Investing in REITs, whether public or personal, offers a sturdy means to diversify your portfolio and generate revenue. This strategic funding selection between public and private REITs must be guided by individual financial objectives, danger tolerance, and investment horizons. Public REITs provide liquidity, transparency, and steady income, making them suitable for conservative traders. In distinction, personal REITs present larger yields and distinctive investment opportunities, interesting to high-net-worth individuals keen to merely accept higher dangers for doubtlessly higher returns. Constant with the noticed inverse relationship between REIT efficiency and Treasury yields, REITs posted a total return of -8.15%.

The market worth of the Singapore-listed Reit has risen some 19.2 per cent in the 12 months thus far. For example, Federal Realty Funding Belief (FRT +0.74%) delivered its 57th consecutive annual dividend increase in 2024, the longest within the REIT trade. Many different REITs have decades-long streaks of increasing their dividends at least as soon as each year. Get stock suggestions, portfolio guidance, and extra from The Motley Idiot’s premium services.

No comment yet, add your voice below!